When you walk into a pharmacy and pick up a generic version of your prescription, you’re benefiting from a legal system designed to keep drug prices low. But behind that simple act lies a complex battle between innovation, profit, and fairness - one shaped by antitrust laws and decades of legal maneuvering in the generic drug market.

How Generic Drugs Became the Norm

In 1984, the U.S. Congress passed the Hatch-Waxman Act to fix a broken system. Before then, branded drug companies held near-monopolies even after their patents expired. Generic manufacturers couldn’t easily enter the market because they had to repeat expensive clinical trials just to prove their version worked the same. The Hatch-Waxman Act changed that. It let generic companies file an Abbreviated New Drug Application (ANDA), proving bioequivalence without redoing full trials. In return, they had to certify whether they were challenging any existing patents.

The law gave the first generic company to file a Paragraph IV certification - meaning they claimed a patent was invalid or not infringed - 180 days of exclusive market access. That single incentive turned the generic drug industry into a high-stakes race. By 2016, generics made up 90% of all U.S. prescriptions, saving consumers over $1.68 trillion between 2005 and 2014. In 2012 alone, Americans saved $217 billion just by choosing generics.

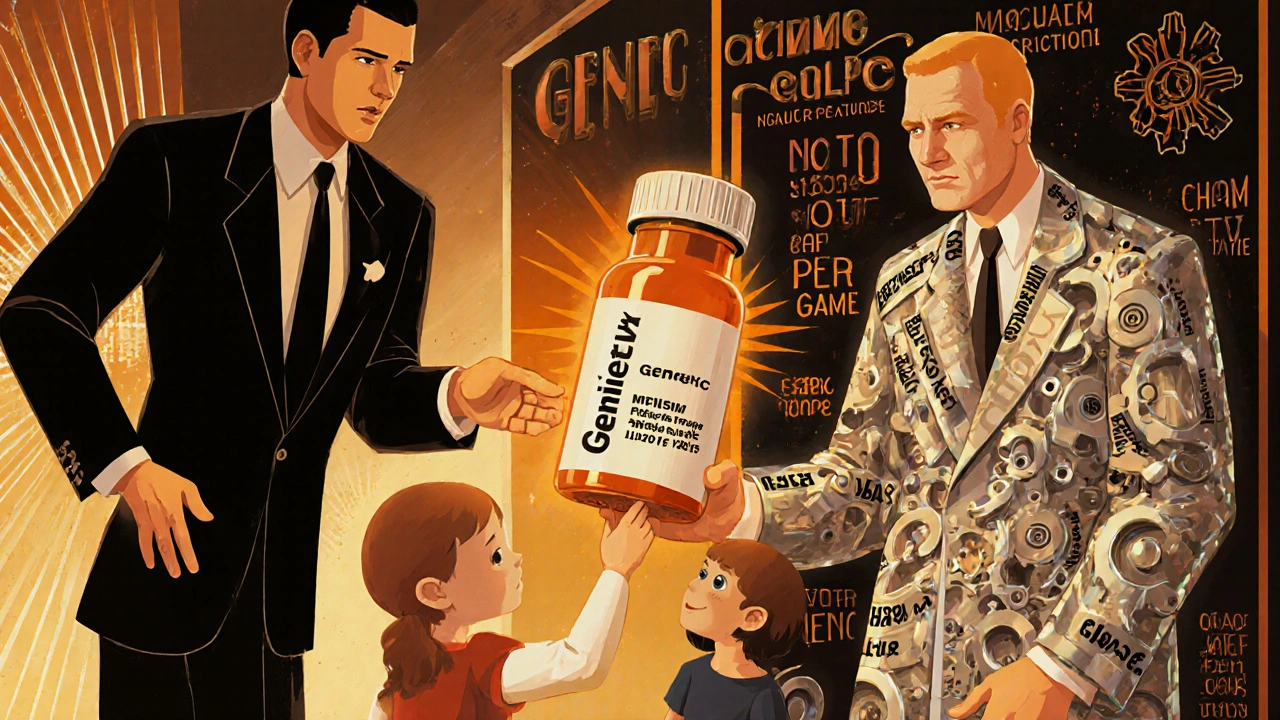

The Dark Side of Competition: Pay-for-Delay and Other Tricks

But not all competition is fair. The same system meant to speed up generics has been exploited. One of the worst abuses is called "pay-for-delay." It happens when a branded drug company pays a generic manufacturer to stay out of the market. Instead of fighting in court, they cut a deal: the generic gets cash, and the brand keeps its monopoly longer.

The Federal Trade Commission (FTC) has called this practice "anticompetitive" and "harmful to consumers." In 2013, the U.S. Supreme Court ruled in FTC v. Actavis that these deals could violate antitrust laws if they involve large, unexplained payments. Since then, the FTC has pursued 18 such cases between 2000 and 2023, with settlements totaling over $1.2 billion. One of the biggest examples? Gilead Sciences paid $246.8 million in 2023 to settle allegations it blocked generic versions of its HIV drug Truvada.

Other tactics are just as sneaky. "Product hopping" is when a brand makes a tiny change to its drug - like switching from a pill to a capsule - right before the patent expires. Then it pushes doctors and patients to switch to the new version, claiming it’s better. Even though the old version is still available, the new one gets new patent protection. AstraZeneca did this with Prilosec and Nexium, and courts have struggled to decide if it’s legal.

Then there’s "sham citizen petitions." Companies file fake complaints with the FDA, claiming safety issues with a generic drug. The FDA has to respond, and the process can delay approval by months or even years. Teva Pharmaceuticals is currently being sued by the FTC for allegedly using this tactic to block a generic version of its multiple sclerosis drug Copaxone.

The Orange Book and Patent Games

The FDA’s "Orange Book" lists every patent linked to a branded drug. Generic companies must check this list and certify against each one. But some branded companies abuse the system by listing patents that don’t even cover the drug’s active ingredient - like packaging patents or method-of-use patents - just to create more hurdles.

In 2003, the FTC took action against Bristol-Myers Squibb for improperly listing patents on its drug Avapro. These weren’t real barriers to generic entry, but they delayed it anyway. The FTC called it a "regulatory manipulation," and it’s still happening today. Companies now list dozens of patents, some of which are weak or expired, just to confuse generic applicants and scare them off.

Global Differences: How Other Countries Handle It

The U.S. isn’t alone in fighting these battles. The European Union has taken a harder line on regulatory abuse. In 2023, the European Commission fined companies for withdrawing marketing authorizations in certain countries to block generic entry. They’ve also cracked down on misleading claims about generic drugs - like telling doctors they’re less safe or effective, even when there’s no evidence.

China just released new antitrust guidelines in January 2025, targeting five "hardcore" violations in pharma: price fixing, market division, output restrictions, joint boycotts, and blocking new technology. As of Q1 2025, six cases had been penalized, and five involved price fixing through text messages, apps, and even algorithms. Chinese regulators are now using AI to monitor pricing patterns across online pharmacies and hospitals.

While the U.S. focuses on reverse payments and product hopping, the EU and China are more focused on systemic manipulation of regulatory processes. That’s why the European Commission estimates that delays in generic entry cost European consumers €11.9 billion every year.

Who Pays the Price?

These legal games don’t just affect corporate profits - they hit real people. A 2022 Kaiser Family Foundation survey found that 29% of U.S. adults skipped or cut doses of their medication because they couldn’t afford it. Many of those cases involved drugs where generic entry was delayed by anticompetitive practices.

When a generic enters the market, prices drop fast. The first generic typically cuts the price by at least 20% in a year. With five competitors, the price falls by nearly 85%. But if that first generic is blocked for a year, the cost stays high. And for chronic conditions - diabetes, high blood pressure, asthma - that delay can mean patients go without treatment.

It’s not just about money. It’s about trust. When patients are told generics are "inferior" or "riskier," they believe it. That’s why disparagement campaigns - where branded companies spread misinformation about generic versions - are so damaging. Courts and regulators are starting to take these claims seriously, but enforcement is slow.

What’s Next?

The FTC’s 2022 workshop on generic drug entry showed that even after a patent expires, barriers remain. New strategies are emerging: companies are buying up small generic manufacturers to control supply chains, or signing exclusive distribution deals with pharmacies to block competitors from getting shelf space.

Regulators are catching on. The FTC is pushing for faster approval of generics, stricter rules on patent listings, and penalties for companies that file sham petitions. Some lawmakers are calling for automatic generic entry on patent expiry, with no exceptions. Others want to ban all pay-for-delay deals outright.

But change won’t come fast. The pharmaceutical industry spends billions lobbying Congress and the FDA. And courts still struggle to draw the line between legitimate patent protection and illegal market manipulation.

For now, the system remains a tug-of-war. On one side, innovation matters. Developing a new drug takes over a decade and costs billions. On the other, access matters. Millions of people rely on affordable generics to survive. Antitrust laws were meant to balance those interests. Too often, they’re being bent - not broken - to serve profits over people.

What is the Hatch-Waxman Act and how does it affect generic drugs?

The Hatch-Waxman Act of 1984 created a legal pathway for generic drug manufacturers to bring cheaper versions of branded drugs to market without repeating expensive clinical trials. It allows generics to file an Abbreviated New Drug Application (ANDA) and grants 180 days of market exclusivity to the first company that successfully challenges a patent through a Paragraph IV certification. This law is why generics now make up 90% of U.S. prescriptions and have saved consumers over $1.6 trillion since 2005.

What is a pay-for-delay agreement?

A pay-for-delay agreement is when a brand-name drug company pays a generic manufacturer to delay launching its cheaper version. Instead of competing in court, the two companies settle with cash in exchange for the generic staying off the market. These deals keep drug prices high and are considered anti-competitive. The U.S. Supreme Court ruled in 2013 that such agreements can violate antitrust laws if they involve large, unexplained payments.

How do companies use the FDA’s Orange Book to block generics?

The Orange Book lists patents associated with a branded drug. Some companies abuse this by listing patents that don’t actually protect the drug’s active ingredient - like packaging, dosage form, or method-of-use patents. These weak or irrelevant patents create legal barriers that scare off generic manufacturers. The FTC has taken action against companies like Bristol-Myers Squibb for this practice, calling it a form of regulatory manipulation.

What is product hopping in the pharmaceutical industry?

Product hopping is when a drug company makes a minor change to its medication - such as switching from a pill to a capsule or adding a new coating - right before its patent expires. It then markets the new version as superior and pushes doctors and patients to switch. This delays generic competition because the original version is no longer promoted, even though it’s still available. AstraZeneca’s switch from Prilosec to Nexium is a well-known example.

How do antitrust laws in China differ from those in the U.S.?

China’s 2025 Antitrust Guidelines for the Pharmaceutical Sector focus on five "hardcore" violations: price fixing, market division, output restrictions, joint boycotts, and blocking new technology. Chinese regulators are actively using AI to detect collusion through messaging apps and pricing algorithms. As of early 2025, most penalized cases involved price fixing through direct agreements or digital communication. In contrast, the U.S. focuses more on pay-for-delay deals, sham petitions, and product hopping.

Why do generic drugs cost so much less than brand-name drugs?

Generic drugs cost less because they don’t need to repeat the expensive clinical trials required for new drugs. Under the Hatch-Waxman Act, they only need to prove they’re bioequivalent to the brand-name version. Since they don’t carry the R&D costs, they can be sold at a fraction of the price - often 30% to 90% cheaper. Competition among multiple generic makers drives prices even lower, sometimes by 85% within a few years.

Kihya Beitz

November 15, 2025 AT 17:59So let me get this straight - we’re celebrating a law from 1984 like it’s the second coming, while Big Pharma just keeps rewriting the rules with a magic marker and a smirk? 🤡

Generics save us billions? Sure. But only after they’ve been held hostage for years by patent trolls in lab coats.

I got my blood pressure med for $4 last month. Meanwhile, the guy who invented it? Probably on a yacht in Monaco, sipping champagne made from the tears of diabetic retirees.

And don’t even get me started on product hopping. Switching from a pill to a capsule? That’s not innovation - that’s a magic trick where the rabbit is your paycheck.

FTC’s chasing these guys like they’re playing whack-a-mole with a butter knife.

Meanwhile, I’m still waiting for my insulin to drop below $300. Oh wait - it’s $320 now. Thanks, capitalism.

They call it ‘antitrust’ like it’s a courtroom drama. It’s not. It’s a rigged casino where the house always wins - and the house is Pfizer.

Someone please tell me why we still let these people write the rules.

Also, why does every generic ad say ‘same active ingredient’ like that’s supposed to comfort me? I don’t want ‘same.’ I want affordable. And I want it yesterday.

And yes, I know the system was designed to help. But it’s been hijacked. Like a Tesla that only drives in circles.

And no, I’m not mad. I’m just… disappointed. Like when you realize your favorite band sold out - but their album still costs $18.

Jennifer Walton

November 16, 2025 AT 22:13Competition is not inherently virtuous. It is merely a mechanism - one that can be weaponized by those who understand the architecture of power.

The Hatch-Waxman Act was not a gift to the public. It was a concession, carefully calibrated to preserve monopoly rents under the illusion of reform.

What we call ‘generic entry’ is often just delayed entry - a controlled release of scarcity to maintain price ceilings just below the threshold of public outrage.

The real tragedy is not the pay-for-delay deals. It is that we accept them as inevitable.

We have built a system that rewards legal ingenuity over moral integrity.

And we call it progress.

Chris Bryan

November 16, 2025 AT 22:15China’s using AI to catch drug price-fixing? That’s socialism with a tech twist.

They’re monitoring text messages? Next they’ll be tracking your breathing to see if you’re ‘too healthy’ and need a prescription.

Meanwhile, here in the U.S., we let corporations buy politicians and call it ‘lobbying.’ At least China’s honest about their control.

But don’t you see? This is all part of the globalist agenda to erase American innovation.

They want us dependent on cheap generics so we stop funding real science.

And the FDA? Totally compromised. Just look at how they approved all those COVID pills - rushed through with zero oversight.

Wake up. This isn’t about drugs. It’s about control.

They’re coming for your pills. Then your freedom. Then your children’s future.

Hollis Hollywood

November 17, 2025 AT 11:55I’ve been on a generic statin for five years now. I used to be terrified of it - thought it was some cheap knockoff that’d give me liver failure.

Then I read the FDA’s bioequivalence studies. Turns out, it’s literally the same molecule. Same chemical structure. Same half-life.

It’s not that generics are inferior. It’s that we’ve been conditioned to fear them.

And that fear? It’s not accidental.

Pharma spent decades convincing doctors and patients that generics were ‘risky’ - even though the science says otherwise.

I remember when my mom refused to switch from her brand-name thyroid med. She cried. Said, ‘It’s the one thing that keeps me alive.’

Turns out, the generic worked better. Her TSH levels stabilized. She gained 12 pounds. She was happier.

But she didn’t tell anyone. Because she felt guilty. Like she’d betrayed the brand.

We’ve been sold a myth. And it’s costing lives.

It’s not about patents or lawsuits. It’s about trust. And someone’s been systematically eroding it.

Maybe the real antitrust violation isn’t pay-for-delay. It’s the psychological manipulation.

Aidan McCord-Amasis

November 18, 2025 AT 11:33Pay-for-delay = corporate bribery. 🤬

Product hopping = magic trick. 🎩

Orange Book abuse = cheating at monopoly. 🎲

Why are we still surprised?

Adam Dille

November 20, 2025 AT 00:13It’s wild how much we take for granted - like walking into a pharmacy and grabbing a $4 pill that keeps you alive.

But behind that? It’s a battlefield.

And honestly? I think most of us don’t even realize we’re soldiers in it.

Every time we choose a generic, we’re voting with our wallets.

Every time we ask our doctor for the cheaper version, we’re pushing back.

It’s not glamorous. It’s not a protest sign. But it’s real.

And it’s working.

Generics aren’t just cheaper - they’re a quiet rebellion.

Maybe the real heroes aren’t the regulators. Maybe they’re the people who just… keep buying the $3 version.

And yeah, the system’s broken.

But we’re still using it to fight back.

Katie Baker

November 20, 2025 AT 00:40I’m so glad someone finally wrote this. I’ve been trying to explain this to my mom for years.

She’s 72. On 6 meds. All generics. She thinks they’re ‘not as good.’

I sat her down. Showed her the FDA charts. The bioequivalence data. The price drops.

She cried. Not because she was sad - because she realized she’d been scared for nothing.

And now? She’s the one telling her friends to switch.

It’s not about being anti-corporate. It’s about being pro-human.

People shouldn’t have to choose between food and their meds.

And if we can fix this? We should.

Not because it’s trendy. But because it’s right.

John Foster

November 20, 2025 AT 22:16There is a deeper metaphysical crisis here - one that transcends antitrust law, patent filings, and FDA regulations.

What we are witnessing is not merely market manipulation - but the erosion of the sacred contract between medicine and humanity.

Once, healing was a covenant. Now, it is a commodity - bartered in boardrooms, encrypted in patents, and monetized through psychological coercion.

The pill is no longer a symbol of care. It is a token in a game of capital accumulation.

And we, the patients, are not customers - we are data points in a predictive algorithm designed to extract maximum value from human vulnerability.

The Hatch-Waxman Act was a moment of hope. But hope, like a drug, has a half-life.

And now, the expiration date has passed.

We do not need more regulations.

We need a reckoning.

Not with corporations.

With ourselves.

For we have allowed this. We have chosen convenience over conscience.

And now, we are paying - not in dollars, but in dignity.

Edward Ward

November 21, 2025 AT 04:00Let’s be precise: the issue isn’t just pay-for-delay - it’s the entire ecosystem of regulatory capture.

The Orange Book isn’t just a list - it’s a legal weapon. Companies are gaming the system by listing patents that are irrelevant, expired, or legally indefensible - and the FDA, by design, has no authority to remove them unless challenged in court.

That means generic manufacturers must spend hundreds of thousands of dollars to litigate against patents that shouldn’t even be there.

And that’s not a loophole - it’s a feature.

The same thing happens with citizen petitions: filing a frivolous safety complaint isn’t just a tactic - it’s a delay engine. The FDA must respond. That takes months. Months that cost patients lives.

And then there’s the psychological impact: when a patient hears, ‘This generic might not work as well,’ they believe it - even if it’s nonsense.

So we’re not just fighting legal battles - we’re fighting perception.

And the worst part? The people who benefit from this system - the CEOs, the lobbyists, the patent attorneys - they don’t even see it as wrong.

They see it as business.

Which is why reform is so hard.

It’s not about changing laws.

It’s about changing culture.

Andrew Eppich

November 22, 2025 AT 13:26The notion that generic drugs are somehow equivalent to branded drugs is a dangerous oversimplification.

While bioequivalence is technically true, it does not account for differences in inactive ingredients, manufacturing tolerances, or patient variability.

Some patients do experience adverse reactions when switching - particularly those with narrow therapeutic windows.

It is irresponsible to dismiss these concerns as mere fear-mongering.

The pharmaceutical industry is flawed, yes.

But so is the assumption that price is the only metric that matters.

Quality, consistency, and safety cannot be reduced to a spreadsheet.

Therefore, regulation must be nuanced - not ideological.

And while I agree that pay-for-delay is problematic, it is not the central issue.

The central issue is the lack of transparency in generic manufacturing.

Where are these pills made? Under what conditions? With what quality controls?

These are the questions we refuse to ask.

Jessica Chambers

November 23, 2025 AT 15:01Wow. I just read this whole thing and… honestly? I’m exhausted.

Like, I get it. The system’s rigged.

But also - I just need my pills to work.

And they do.

So maybe we can fix the system… but also, can we just let people have their $3 blood pressure meds without turning this into a 10-part Netflix docuseries?

Also - I’m not mad. I’m just… done.

😭