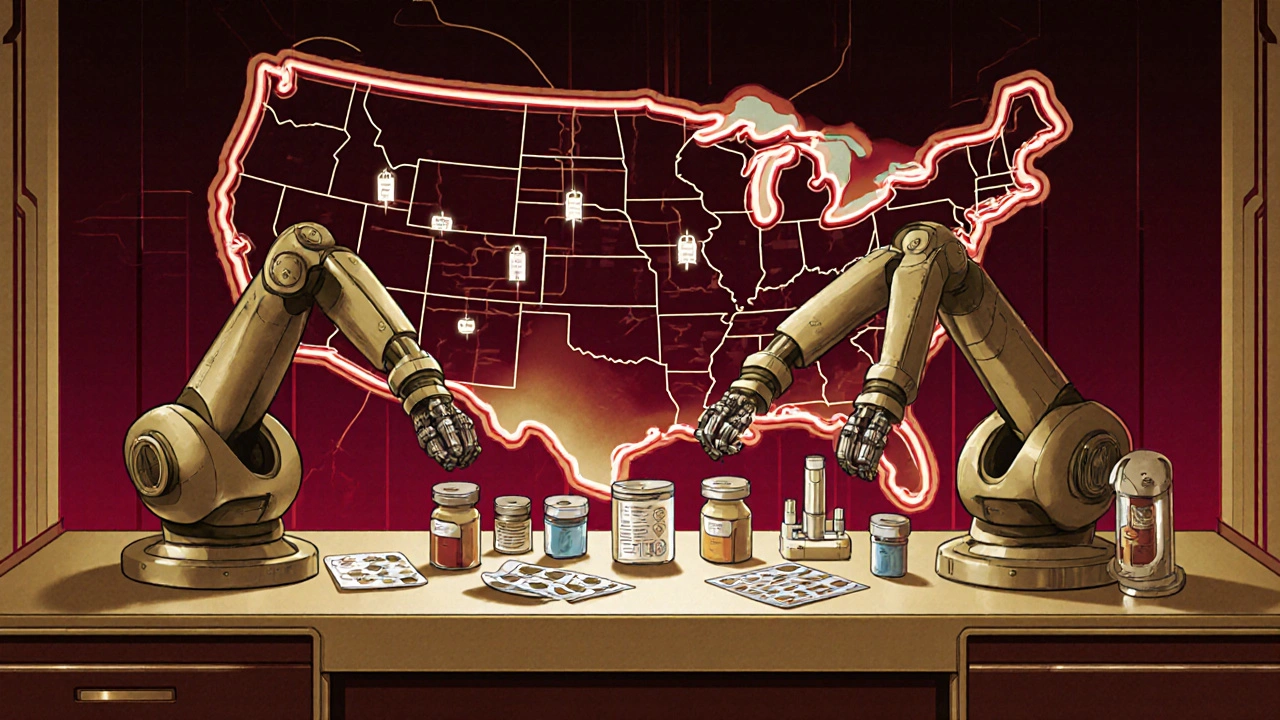

Generic drugs used to be simple: copy the brand, prove it works the same, sell it for a fraction of the price. But that era is over. Today, the biggest growth in generics isn’t coming from plain pills anymore-it’s from generic combinations. These aren’t just copies. They’re smarter, more complex versions of older drugs-sometimes mixing two active ingredients into one pill, sometimes bundling a drug with a smart inhaler or auto-injector, sometimes changing how the medicine releases in your body over time. And they’re changing everything about how generics compete.

What Exactly Are Generic Combinations?

Generic combinations, often called super generics, go beyond the old model of copying a single active ingredient. They combine multiple drugs into one dosage form-like a pill that has both a blood pressure medication and a diuretic-or pair a drug with a delivery device, like an inhaler that automatically measures your dose. Some even use new tech to control how the drug is absorbed-extended-release versions that last 12 hours instead of 4, or targeted-release systems that avoid stomach irritation.

Take EpiPen alternatives. The original was a branded auto-injector. Generic versions didn’t just copy the epinephrine. They rebuilt the whole device-making it cheaper to produce, easier to use, and just as reliable. That’s a combination product. Or look at bupropion: the original brand version was an extended-release tablet. The generic version didn’t just copy it-it improved the release profile, making it more consistent. That’s why it made $187 million a year before competition hit, while plain bupropion generics barely hit $42 million combined.

These aren’t gimmicks. They solve real problems. Patients forget to take multiple pills. Complex drug regimens lead to missed doses. Poor absorption causes side effects. Generic combinations fix that-without the brand-name price tag.

Why Are They Growing So Fast?

The numbers don’t lie. The global super generics market hit $235.6 billion in 2025 and is expected to hit nearly $475 billion by 2035. That’s a 7.2% annual growth rate. Why? Because the old generic model is collapsing under price pressure.

Traditional generics? Once launched, they lose 80-90% of their price within two years. Margins vanish. Companies can’t make money on them anymore. But generic combinations? They keep 40-60% of their launch price five years later. That’s the difference between barely breaking even and building a sustainable business.

And there’s a tidal wave of expiring patents coming. Between 2025 and 2030, drugs worth $217-$236 billion in annual sales will lose exclusivity. Think Trelegy Ellipta-$2.8 billion in sales in 2024 alone. Or Austedo, a complex CNS drug at $1.2 billion. These aren’t small pills. They’re high-value, high-complexity products. And the companies that can replicate them with better delivery, better compliance, or better safety will dominate the next decade.

It’s not just about money. It’s about healthcare systems needing better outcomes. In the U.S., generics fill 90% of prescriptions but make up only 20% of total drug spending. That means the system is paying for volume, not value. Generic combinations flip that. They deliver better results-fewer hospital visits, fewer side effects, better adherence-and still cost less than the brand.

The Regulatory Maze

If you think getting a simple generic approved was hard, try a combination product. The FDA treats them as a different beast entirely.

Simple fixed-dose combinations (like two pills in one tablet) still go through the Abbreviated New Drug Application (ANDA) process. But now, they need more than just bioequivalence. They need proof that the combination works better than taking the drugs separately. That means extra clinical data-sometimes 30-50% more than a standard generic.

Drug-device combos? That’s another level. The FDA’s Office of Combination Products has to decide: is this a drug first, or a device first? That determines which team reviews it, which standards apply, and how long it takes. Inhalers, auto-injectors, smart patches-all of these require testing the device’s reliability, the drug’s stability inside it, and how the two interact over time.

Modified-release formulations? They need specialized pharmacokinetic studies. You can’t just compare blood levels. You need population modeling to show the drug releases the same way in different people-older patients, those with liver issues, different body weights.

And here’s the kicker: 78% of combination product rejections aren’t because the drug doesn’t work. They’re because the delivery system didn’t meet specs. A tablet that breaks too fast. An inhaler that doesn’t dispense the right dose. A patch that doesn’t stick in humid weather. These aren’t theoretical problems-they’ve killed dozens of applications.

The FDA is trying to catch up. In October 2025, they launched a pilot program that fast-tracks reviews for combination products made entirely in the U.S. Approval timelines could drop by 3-6 months. But the European Medicines Agency (EMA) is still playing it safe. Only 12 complex combinations got approved in the EU through early 2025. The U.S. approved 37. That’s a huge gap-and it means companies can’t treat global markets the same way.

Who’s Winning and Why

This isn’t a race for the smallest manufacturer. It’s a battle for the ones with deep pockets, advanced tech, and regulatory savvy.

Companies like Teva, Viatris, and Sandoz are pouring billions into this space. Viatris and Credence merged for $2.3 billion in 2025-specifically to build up their complex generics team. Aspen Pharmacare is working on generic versions of semaglutide combinations, targeting the $100+ billion weight-loss and diabetes market. Catalent, a device maker, is partnering with Hikma to build auto-injectors for generic drugs. These aren’t random moves. They’re strategic bets on the future.

India is the manufacturing powerhouse-producing 35% of the world’s complex generics. But the U.S. leads in market value, with 42% of global sales. Why? Because reimbursement policies here reward innovation. Medicare and private insurers will pay more for a combination that reduces hospitalizations, even if it costs $20 more per month.

And the winners aren’t just the big players. Niche companies with specialized tech-like those using hot-melt extrusion to create stable extended-release pills, or lipid-based systems to improve absorption-are getting acquired by giants. It’s not about being big. It’s about being precise.

Where the Industry Is Headed

Three trends are clear.

First, complexity equals pricing power. Products with two innovations-say, a fixed-dose combo with extended release-can command 2-3 times the price of a simple generic. That’s the new profit engine.

Second, regulatory divergence is growing. The U.S. is becoming more flexible. The EU is more cautious. China and Brazil are building their own frameworks. Companies can’t use one global strategy anymore. They need regional roadmaps.

Third, partnerships are replacing competition. Pharma companies are teaming up with device makers, contract manufacturers, and even software firms to build smarter delivery systems. A generic inhaler isn’t just a drug anymore-it’s a connected device that tracks usage and sends alerts to patients’ phones. That’s the future.

But it’s not all smooth sailing. IQVIA says the U.S. generics market will grow 11.4% in 2025-but Morningstar warns that without innovation, margins could collapse by 30% over the next decade. The pressure to keep prices low is relentless. If companies don’t keep moving into higher-value combinations, they’ll be squeezed out.

What This Means for Patients and Providers

For patients, this is good news. More effective, easier-to-take medicines at lower prices. Fewer pills in the morning. Fewer side effects. Better control of chronic conditions like asthma, diabetes, or depression.

For doctors, it means more options-but also more questions. Is this combination truly better? Is it proven? Is the delivery system reliable? You can’t assume a generic combination is just like the brand. You need to know the data behind it.

For payers, it’s a chance to reduce long-term costs. A combination that improves adherence cuts emergency visits and hospital stays. That saves more than the extra cost of the drug.

The bottom line? Generic combinations aren’t a side project anymore. They’re the future of the entire generic industry. The days of copying pills are over. The new game is about solving real problems-with smarter science, better tech, and sharper regulation.

What’s the difference between a generic drug and a generic combination?

A traditional generic copies a single active ingredient from a branded drug and proves it works the same way. A generic combination adds something new-like combining two drugs into one pill, embedding a drug in a smart device, or changing how the drug is released in the body. It’s not just a copy; it’s an improved version that offers better dosing, fewer side effects, or easier use.

Why are generic combinations more expensive to develop?

Traditional generics cost $1-$5 million and take 2-3 years to develop. Generic combinations cost $15-$50 million and take 4-7 years. Why? They need extra clinical data, complex testing for delivery systems, specialized manufacturing equipment, and regulatory reviews that involve multiple FDA teams. A simple pill is straightforward. An auto-injector with a drug inside? That’s a medical device too-and it has to work every single time.

Are generic combinations safe?

Yes-if they’re approved. The FDA requires them to meet the same safety standards as branded drugs, often with more testing. But because they’re more complex, there’s a higher risk of failure during review. About 78% of rejections happen because the delivery system (like an inhaler or tablet coating) doesn’t perform consistently. That’s why not every company can make them. Only those with real technical expertise succeed.

Why is the U.S. market leading in generic combinations?

The U.S. has a reimbursement system that rewards innovation. Insurers and Medicare will pay more for a combination product that improves adherence or reduces hospitalizations. The FDA also has a more flexible approach to approving complex products. In contrast, the EMA in Europe is more conservative, approving only about one-third as many complex combinations. That makes the U.S. the most attractive market for developers.

What’s next for generic combinations?

The next wave will include multi-drug combinations for chronic diseases-like diabetes and heart failure in one pill-and connected devices that track usage and send data to doctors. We’re also seeing the rise of generic versions of biologics and complex injectables. The real winners will be companies that can combine pharmaceutical science with device engineering and digital health tools. It’s no longer just about the drug-it’s about the whole system that delivers it.

Douglas Fisher

November 25, 2025 AT 16:48Wow. I just read this three times. I mean, seriously-this isn’t just about pills anymore. It’s about devices, timing, adherence, and even software. The EpiPen example? That’s genius. And the fact that 78% of rejections are because of the delivery system? That’s wild. I never thought about how a patch failing in humid weather could kill a whole product. I’m impressed-and honestly, a little scared for anyone trying to make these.

Vanessa Carpenter

November 25, 2025 AT 21:21It’s funny how we still call them ‘generic’ when they’re basically new inventions. Like, if you’re adding smart tech and controlled release and combo dosing… that’s not copying. That’s reinventing. And honestly? Patients win. Fewer pills, fewer side effects, fewer ER trips. Why are we still acting like this is just ‘cheap medicine’? It’s smarter medicine.

Bea Rose

November 26, 2025 AT 14:08Costs $50M to develop. Takes 7 years. FDA rejects 78% over device flaws. And you think this is sustainable? Tell me again why we’re not just paying for the brand.

Michael Collier

November 26, 2025 AT 16:16While the economic and regulatory dynamics presented are compelling, one must not overlook the ethical imperative to ensure equitable access. The U.S. market’s favorable reimbursement policies, while incentivizing innovation, risk exacerbating global disparities. If complex generics remain concentrated in high-income jurisdictions, the promise of broader healthcare equity may remain unfulfilled.

Shannon Amos

November 27, 2025 AT 23:44So let me get this straight-we spent 20 years fighting to make pills cheaper, and now the industry’s like ‘nah, let’s make them fancy and charge 3x more’? Classic capitalism. But… I guess if it means I don’t have to remember to take 4 pills at 3 different times? I’ll take it. Still feels like a trap though.

Wendy Edwards

November 29, 2025 AT 15:00OMG YES. I have asthma and my inhaler used to cost $500. Now I get a generic combo that tracks my usage and reminds me via app? For $45? My doctor didn’t even know it existed until I showed her. I’ve had zero attacks since switching. This isn’t just innovation-it’s life-changing. Someone should make a documentary on this. Like, seriously. People need to know this is happening.

Jaspreet Kaur

December 1, 2025 AT 02:40In India we make these but never own them. We build the device the drug the packaging but the patent and profit stays in Chicago or Basel. Is this progress or just new colonialism in pill form? The patient gets the medicine but the soul of the innovation? It never crosses the ocean. We are the hands but not the minds. And yet… we fix the world’s supply. What does that say about us?

Gina Banh

December 2, 2025 AT 14:15Bea’s point is valid-but missing the bigger picture. Yes, development is expensive. But look at the cost of non-adherence: $300B/year in the U.S. alone. A $50M investment that cuts hospitalizations by 15%? That’s a net savings. The FDA’s pilot program? Smart. They’re finally treating these like what they are: medical systems, not just drugs. The real threat isn’t cost-it’s inertia. If payers don’t update reimbursement models, we’ll lose this momentum. And then patients lose again.