When a patient needs an IV drip, an anesthetic before surgery, or chemotherapy to fight cancer, they expect the right medication to be ready-right now. But in hospitals across the U.S., that’s no longer a guarantee. As of July 2025, there were 226 active drug shortages affecting the healthcare system, and nearly two-thirds of them involve sterile injectables. These aren’t minor inconveniences. They’re life-or-death gaps in care that hospital pharmacies are forced to manage every single day.

Why Injectables Are the First to Go Missing

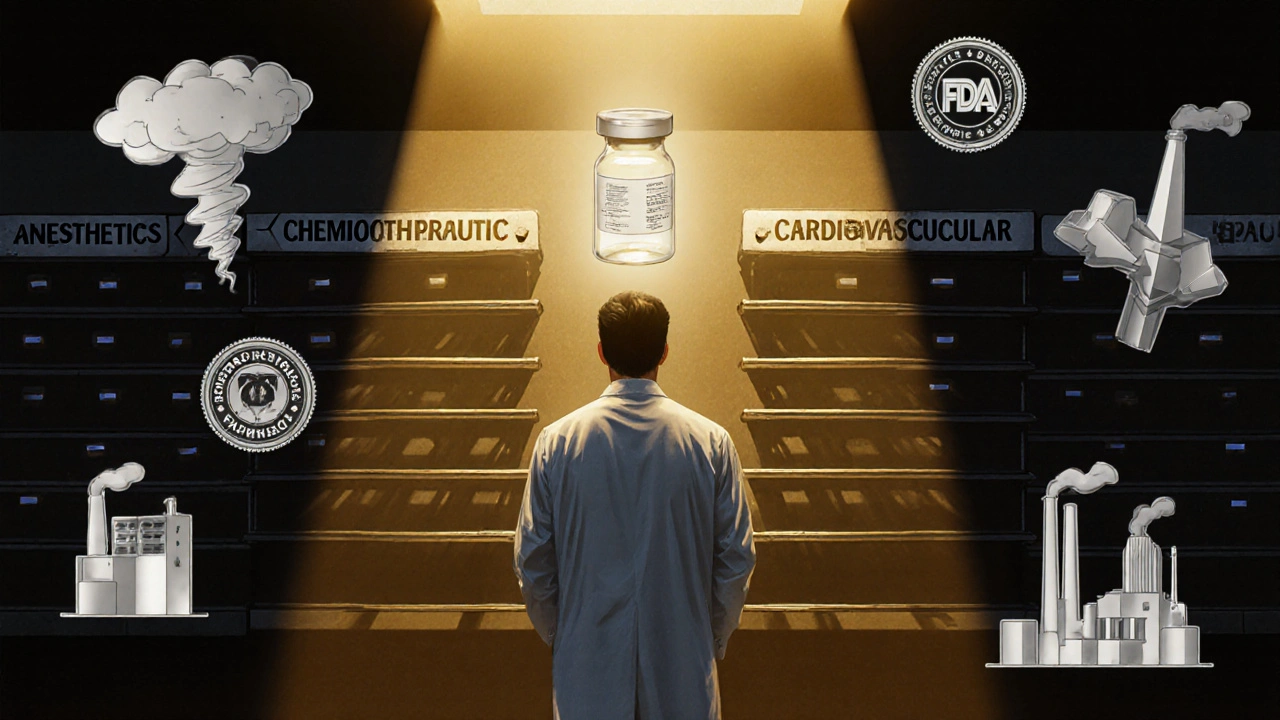

Not all medications are created equal when it comes to supply chain fragility. Injectable drugs-especially sterile ones-require a level of precision that oral pills simply don’t. They’re made in clean rooms, tested for bacteria, filled in controlled environments, and packaged to avoid contamination. One tiny error in the manufacturing process can shut down an entire production line for months. About 80% of the active pharmaceutical ingredients (APIs) used in these injectables come from just two countries: China and India. A single tornado in North Carolina, like the one that hit a Pfizer plant in October 2023, can knock out 15 critical medications at once. Or an FDA inspection in India flags quality issues with cisplatin, a key chemotherapy drug, and production halts overnight. These aren’t rare events. They’re becoming the norm. And when they happen, hospitals feel it hardest. Injectable medications make up 60-65% of all drugs in shortage. Why? Because they’re low-margin products. Most manufacturers operate on profit margins of just 3-5%. There’s little financial incentive to invest in backup equipment, redundant supply chains, or advanced manufacturing tech like continuous production-which only 12% of companies have adopted. When a supplier can’t make money on a drug, they stop making it. And when they do, they often don’t have the capacity to ramp up quickly.Hospital Pharmacies Are Not Retail Pharmacies

A community pharmacy might run out of a painkiller or antibiotic and swap it for a similar one. It’s inconvenient, but rarely dangerous. Hospitals don’t have that luxury. In a hospital, you can’t just substitute a different brand of saline solution. The concentration, pH, and sterility matter. A slight variation can cause a patient’s blood pressure to crash or trigger an allergic reaction. That’s why therapeutic interchange-switching to a different drug-isn’t a simple decision. It requires approval from a pharmacy and therapeutics committee, which can take days. In emergencies, there’s no time. While retail pharmacies deal with shortages affecting 15-20% of their inventory, hospital pharmacies report that 35-40% of their essential drugs are in short supply. And the most critical categories are hit hardest:- Anesthetics: 87% shortage rate

- Chemotherapeutics: 76% shortage rate

- Cardiovascular injectables: 68% shortage rate

The Human Cost Behind the Numbers

Behind every shortage statistic is a nurse, a pharmacist, and a patient caught in the middle. A nurse manager at Massachusetts General Hospital documented that 37 surgical procedures were delayed in just one quarter of 2025 because the anesthetics weren’t available. Patients were rescheduled. Families were anxious. Staff were exhausted. Hospital pharmacists now spend an average of 11.7 hours a week just trying to find alternatives. That’s over a full workday each week-not treating patients, not reviewing charts, not educating staff. Just chasing drugs. And it’s not just about logistics. It’s about ethics. Sixty-eight percent of hospital pharmacists say they’ve faced moral dilemmas during shortages. Forty-two percent admit they’ve had to use less effective alternatives because there was nothing else. One pharmacist on Reddit wrote: “Running out of normal saline for three weeks straight forced us to get creative with oral rehydration for post-op patients-never thought I’d see the day.” Elderly patients, especially those between 65 and 85, are hit hardest. Over 30% of people affected by drug shortages fall into this group. They’re the ones in ICUs, the ones getting chemo, the ones on IV antibiotics after surgery. When their meds disappear, they’re the ones who suffer the most.What Hospitals Are Doing to Cope

No one is sitting idle. Hospitals have had to build emergency systems from scratch. Most now have formal shortage management committees. But only 32% of them feel these teams are properly funded or staffed. Many rely on outdated spreadsheets or word-of-mouth alerts from other hospitals. Only 45% have updated, written protocols for handling shortages. The rest wing it. Some of the most effective tactics include:- Consolidating stock of scarce drugs into one central location to reduce waste

- Pre-approving therapeutic alternatives so substitutions can happen fast

- Building direct relationships with smaller, regional suppliers

- Using tiered allocation systems to prioritize the sickest patients

Alyssa Fisher

November 9, 2025 AT 12:25It's wild how we treat life-saving injectables like disposable consumer goods. We outsource production to countries with cheaper labor, then act shocked when a tornado or FDA audit breaks the chain. We've optimized for profit, not resilience. And now nurses are rationing saline like it's gold. There's a philosophical irony here: we've built the most advanced medical system on earth, but we can't guarantee the most basic inputs. It's not a logistics failure-it's a moral one.

Alyssa Salazar

November 10, 2025 AT 17:59Let’s be real-the API oligopoly is the root cause. China and India control 80% of the raw materials, and the FDA’s ‘pre-approval’ process is a joke when it takes 18 months to certify a new supplier. Meanwhile, generics are priced into oblivion. No one’s making a dime on sodium chloride, so why would any pharma exec invest in redundant lines? We need mandatory ROI floors for essential injectables. Or just nationalize the damn supply chain. This isn’t capitalism-it’s a hostage situation.

Beth Banham

November 11, 2025 AT 10:37I work in a small rural hospital. We’ve had to use oral fluids for post-op hydration twice this year. It’s not ideal, but we make it work. The pharmacists are saints. They’re the ones staying late, calling every distributor in three states, begging for a single vial. No one talks about them. But they’re the ones keeping people alive when the system fails. Just… thank you, hospital pharmacists. We see you.

Brierly Davis

November 12, 2025 AT 07:47Y’all are right to be mad, but let’s not forget the frontline heroes. 🙌 I know a nurse who once substituted a different vasopressor because the real one was gone-she double-checked everything, called the doc, and saved a guy’s life. That’s the kind of grit we need more of. Maybe we can’t fix the system overnight, but we can support the people holding it together. High five to every pharmacist who’s ever cried over a spreadsheet.

Amber O'Sullivan

November 12, 2025 AT 13:36Stop pretending this is new. We’ve known this was coming for 20 years. The FDA lets foreign plants operate with zero oversight. The government subsidizes Big Pharma but won’t touch the generics. And now we’re surprised when kids with leukemia get delayed treatment? Wake up. This is policy failure dressed as tragedy. No more band-aids. We need a war footing. Now.

Jim Oliver

November 13, 2025 AT 21:30Wow. Just… wow. A 15-sentence essay on saline shortages. And yet, not one person mentioned that the real problem is the FDA’s 12-year approval process for biosimilars? Or that 70% of these shortages are caused by manufacturers who can’t even pass a basic GMP inspection? And you wonder why hospitals are scrambling? Because the entire regulatory ecosystem is a glorified bingo card for incompetence.

William Priest

November 14, 2025 AT 14:38ok so like… the real issue is that we’re all just… kinda… lazy? Like, why are we still making injectables the same way we did in 1985? We have 3d printing and AI and drones and stuff. But nope, we’re still using glass vials and manual filling machines because ‘that’s how it’s always been’. Also, China is kinda sus tbh. Like, why are we letting them control 80% of our meds? We’re basically paying them to hold our lives hostage. Just saying.

Ryan Masuga

November 15, 2025 AT 13:53I get why this feels hopeless, but small wins matter. My hospital started pre-approving 12 alternative meds last year. We cut our response time from 72 hours to 8. That’s huge. And we’re talking to local compounding pharmacies now-turns out, they can make sterile saline in 48 hours if we give them the right specs. It’s not perfect, but it’s progress. We’re not powerless. We just need to stop waiting for Washington and start fixing what we can.

Jennifer Bedrosian

November 16, 2025 AT 13:35OMG I just read this and I’m crying. I had my mom on chemo last year and they ran out of the drug for 3 weeks. They gave her a different one and she got so sick. The nurses were in tears. I called the FDA. No one answered. I posted on TikTok. Got 50k views. Then nothing. This is not a system. It’s a horror movie. And we’re all just watching while our loved ones fade away. Someone needs to do something. PLEASE.

Lashonda Rene

November 17, 2025 AT 08:50i think maybe we need to think about this differently like instead of just trying to fix the supply chain maybe we should think about how we can make the medicines themselves easier to make or maybe even make them not need to be injected at all like if we could make pills that work just as good for chemo or something like that i mean why do we always assume injection is the only way i know its not always possible but maybe we should be investing more in alternatives instead of just trying to keep the old system running when its clearly broken like maybe its time to think outside the vial